Archived Storm Damage Blog Posts

When Flooding or Storms hit SERVPRO of Hammond is Ready

4/15/2021 (Permalink)

SERVPRO of Hammond specializes in storm and flood damage restoration. Our crews are highly trained and we use specialized equipment to restore your property to its pre-storm condition.

Faster Response

Since we are locally owned and operated, we are able to respond quicker with the right resources, which is extremely important. A fast response lessens the damage, limits further damage, and reduces the restoration cost.

Resources to Handle Floods and Storms

When storms hit Tangipahoa, we can scale our resources to handle a large storm or flooding disaster. We can access equipment and personnel from a network of 1,900 Franchises across the country and elite Disaster Recovery Teams that are strategically located throughout the United States.

Have Storm or Flood Damage? Call Us Today (985)-542-7388

Faster to Any Size Floor Disaster

4/14/2021 (Permalink)

According to the National Weather Service (NOAA), "Approximately seventy-five percent of all Presidential disaster declarations are associated with flooding." NOAA lists the most common flood hazards in the United States as:

- Flash Flooding

- River Flooding

- Storm Surge and Coastal Inundation from Tropical and Non-Tropical Systems

- Burn Scars/Debris Flows (Caused by Wildfires)

- Ice/Debris Jams

- Snowmelt

- Dry Wash (caused by heavy rainfall in dry areas)

- Dam Breaks/Levee Failures

Just because you haven't experienced a flood doesn't mean you will not in the future. In fact, 20% of all claims paid by the National Flood Insurance Program (NFIP) were for policies in low-risk communities. On average, floods cost $3.5 billion in annual losses in the United States.

When catastrophic water damage happens to you, SERVPRO of Hammond can help. They can help you prepare ahead of time with an Emergency Ready Profile (ERP), or respond to any size disaster to begin cleanup and restoration to get you back in your home as soon as possible.

SERVPRO of Hammond is ready to help make it "Like it never even happened."

Know the Difference Between Flood and Homeowners Insurance

4/12/2021 (Permalink)

The differences are substantial, and most definitely worth reviewing. Our first piece of advice is to consult with your insurance agent to understand the differences in your policies, so you know what covers what ... and what might NOT be covered.

Typically, flood insurance pays for damages caused by the rising of a body of water that covers normally dry land. For example, if heavy rains cause a river to overflow and the waters from this river rise up and enter your property from the ground, this would be a "flood" and you would likely tap your flood insurance policy for coverage; homeowners insurance would not apply. On the other hand, if a toilet supply line burst in your property and spread water into your home, the opposite would be true.

These distinctions are critical for many reasons. Chief among them is the fact that many people think they are covered for both types of losses by having one type of policy, alone. This can be a costly mistake! Among the other important distinctions: In our experience at SERVPRO of Hammond, flood, insurance policies tend to be far less forgiving. The flood insurance programs tend to not cover many necessary items of a cleanup bill, and a property owner can end up being responsible for a larger portion of a cleanup bill compared to a standard homeowner loss.

These distinctions are increasingly important especially for property owners and property managers on waterways, which are seeing higher incidences of flood losses.

Apologies for the cliché, but an ounce of prevention is worth a pound of cure. Being educated on these important distinctions is the first step toward securing that ounce of prevention.

Do You Know What To Do When A Flood Happens?

4/9/2021 (Permalink)

Floods are one of the most common and widespread natural disasters in the United States. Whether your home or business is near a coastline, along with city streets, in the mountains, near a river, or even in the desert—there is always a potential for flood damage. Fema.gov reports in the last 5 years, all 50 states have experienced floods or flash floods. Just because you haven’t experienced a flood in the past does not mean you won’t in the future. In fact, nearly 20% of all flood insurance claims come from moderate-to-low risk areas, and even just one inch of flood damage in an average home can cost you up to $27,000.*

According to the American Red Cross, floods cause more damage in the U.S. every year than any other weather-related disaster. The American Red Cross offers the following flood safety tips.

- Stay away from floodwaters. If you come upon a flowing stream where water is above your ankles, stop, turn around, and go another way. Six inches of swiftly moving water can sweep you off of your feet.

- If you approach a flooded road while driving, turn around and go another way. If you are caught on a flooded road and waters are rising rapidly around you, get out of the car quickly and move to higher ground. Most cars can be swept away by less than two feet of moving water.

- Keep children out of the water. They are curious and often lack judgment about running water or contaminated water.

If a flood does strike your home or business, contact SERVPRO® of Hammond at 985-542-7388. Even minor floods have the potential to cause major damage to a structure when not treated quickly and properly, and the cleanup is often an overwhelming task. The SERVPRO® System is prepared to handle any sized disaster. When fire and water take control of your life, SERVPRO® of Hammond will help you take it back.

When it Floods, What to Do and What to Avoid

5/6/2020 (Permalink)

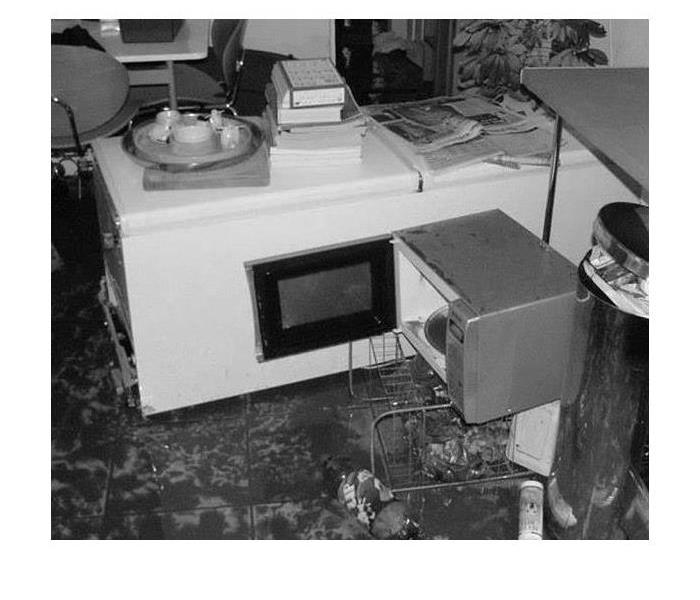

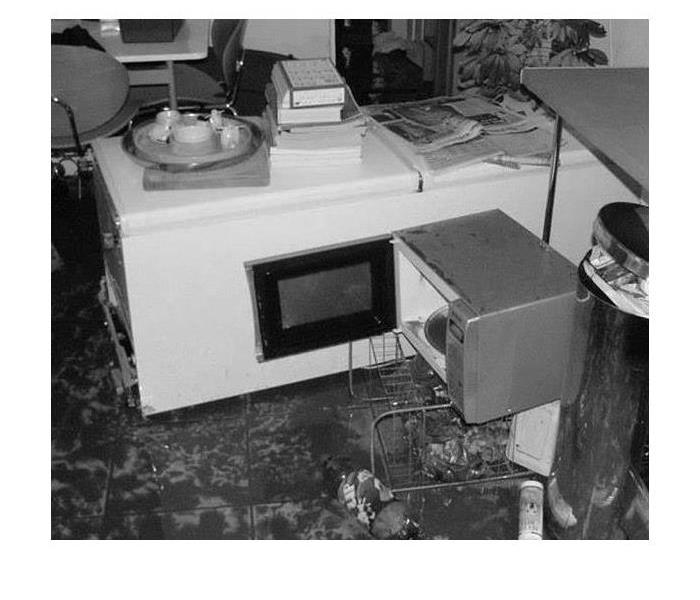

When your home or business in Tangipahoa Parish floods, whether from a storm or a broken pipe, your first instinct is probably to start getting rid of water and cleaning up. To makes sure the repair process goes smoothly, however, there are a few steps you should follow. The first priorities are safety and documentation, and then you can call flood restoration specialists to lead in the cleanup efforts.

Safety First

There are a few things to look for when you return:

• Damage to water, sewer or power lines

• Warped surfaces, such as floors or walls

• Damaged foundation

• Visible cracks or holes in any part of your home’s structure

Try to avoid wading in standing water, as it could be electrically charged. Just in case, it is a good idea to wear knee-high rubber boots to absorb possible shocks. Even if the water looks clean, avoid contact with your skin, as it could be contaminated, especially if you suspect it might have come from a broken pipe or sewer line.

Document Damage

Your insurance adjuster is going to need to know the extent of the damage. Be vigilant about keeping your cell phone charged so you can take pictures for the report. Avoid cleaning before you document the damage, or your settlement could be smaller because the problem will seem smaller than it actually is. Once you have adequate documentation, call your insurer. The earlier you file a claim, the sooner you can get the money for repairs or reimbursement.

Cleanup

Rather than attempt to clean up the water yourself, it is a good idea to hire a professional. Experienced restoration specialists can help locate the cause of the problem, whether the flooding came from groundwater or a broken pipe. They also know how to overcome water damage so that you do not experience mold or mildew problems later.

When your home or business in Tangipahoa Parish experiences flooding, it is natural to want to put it behind you quickly. With the proper process, however, you can be assured that the resolution is complete.

Call the professionals at SERVPRO of Hammond at (985) 542-7388. We're always here to help.

3 Reasons Not to Wait for an Adjuster to Visit before Restoring Your Home

5/5/2020 (Permalink)

After your home in Tangipahoa Parish has sustained water damage due to a flood, flood insurance often requires an adjuster to come to your home to assess the damage that has been done. However, waiting for an adjuster’s inspection, before performing mitigation step is often not necessary for several reasons.

1. Adjusters Are Busy

Once a natural disaster has occurred, insurance companies immediately begin to work with their customers to help them restore their homes. However, the demand for an adjuster to visit homes can mean you’ll be waiting to see an adjuster. Waiting to begin making major fixes to your home isn’t necessary, and you can document the damage that has been done by taking photographs and saving receipts.

2. You Won’t Lose Money Cleaning Up

Although you might be tempted to leave your home exactly as it is after it has sustained FLOOD damage, you will not receive less compensation if you start the cleanup process quickly. It is likely that you will want or need certain items removed from your home before your flood insurance company sends an adjuster to visit your home, and this is okay. Documenting the cleanup process can help to ensure you are fairly compensated for your losses.

3. Your Home Could Become More Damaged

Minor issues in your home can quickly become major issues if they are not fixed in a timely manner. Structural damage, mold damage and more can occur if your home is not dried out and if standing water is not removed. In order to save yourself from having to spend more money, time and effort in restoring your home, it’s often wise to start the restoration process quickly.

Knowing that you do not have to wait for your flood insurance company to send an adjuster to your home before beginning the restoration process might help you save money and protect your home. As you start the restoration process, many people find it helpful to work with professionals in water damage cleanup and restoration. If you have experienced damage to your home due to flooding call SERVPRO of Hammond at (985) 542-7388

24/7 Emergency Service

24/7 Emergency Service